If you have only five minutes then read this.

In October we released an article teasing an analysis of the shopping SERPs being rolled out to the UK. Since then we have amassed and analysed more than 25K search results by around 3K keywords. This is that prophesied analysis, chock-full of insight:

- Paid and unpaid shopping listings appear together 100% of the time. You heard me.

- The same site rarely appears across both paid and unpaid listings in a single search.

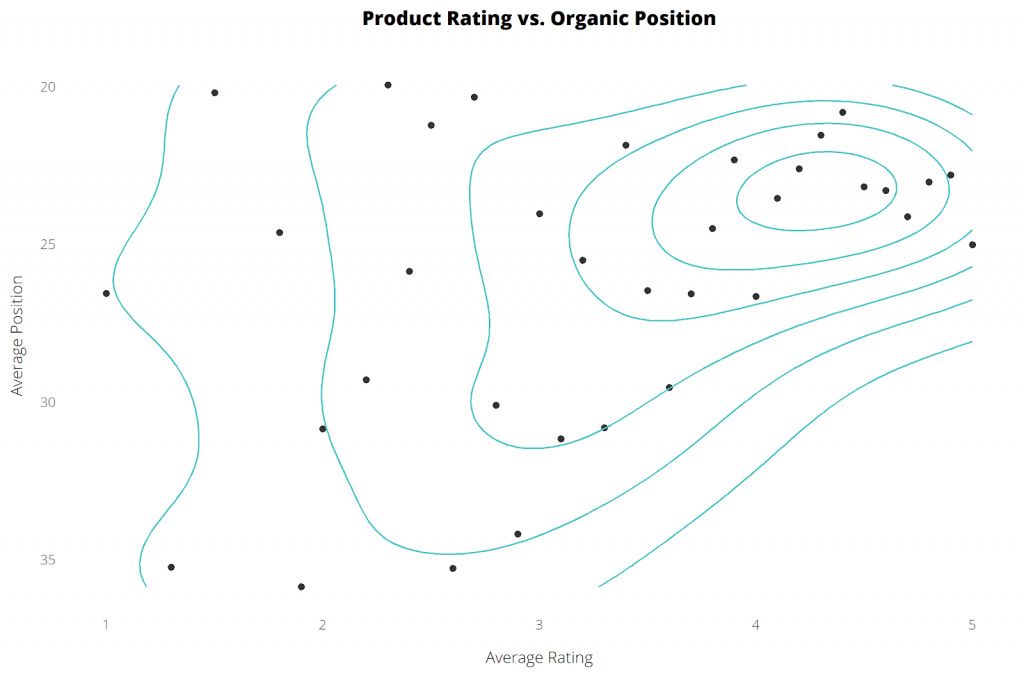

- Positive product ratings are strongly correlated with strong organic ranking positions – correlation coefficient of 0.40 i.e. “moderate correlation” (Source).

- There is a substantial disparity between big ecommerce sites with some relying entirely on organic coverage (e.g. Zalando) while others throw their money at ads (e.g. Amazon). In general though, it is a mixed bag.

- Unpaid listings have opened up the Shopping floodgates to companies who can compete without ads as we have observed many companies appearing across unpaid listings without ever ranking for a single visible ad.

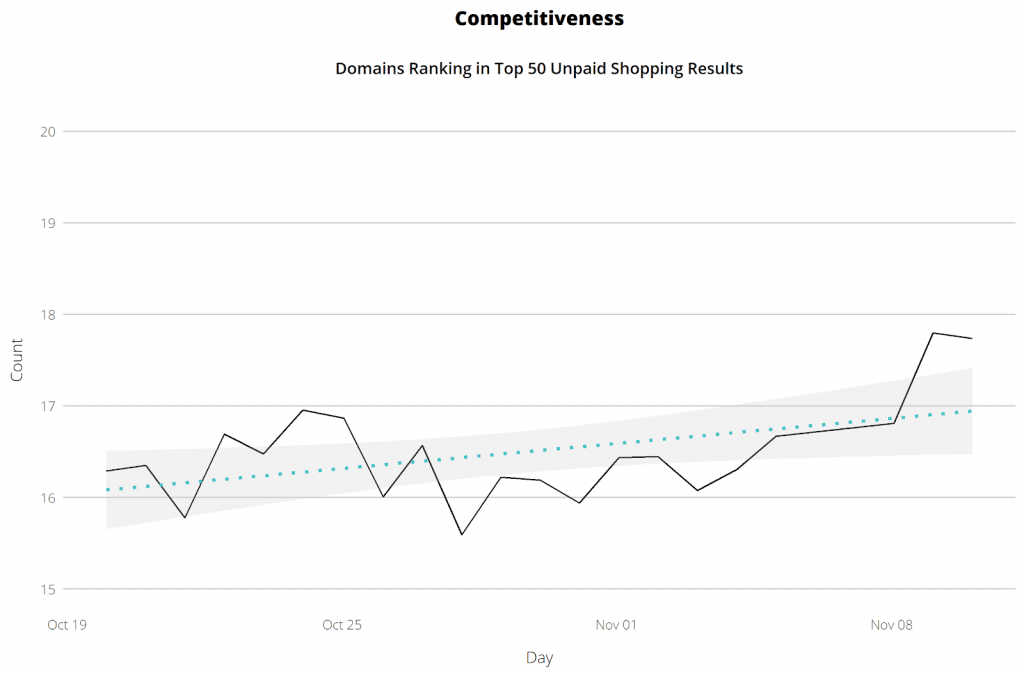

- The number of distinct domains competing across the first 50 unpaid shopping results has been experiencing a slow incline although it may be too early to tell if this will continue, or if this means anything at all.

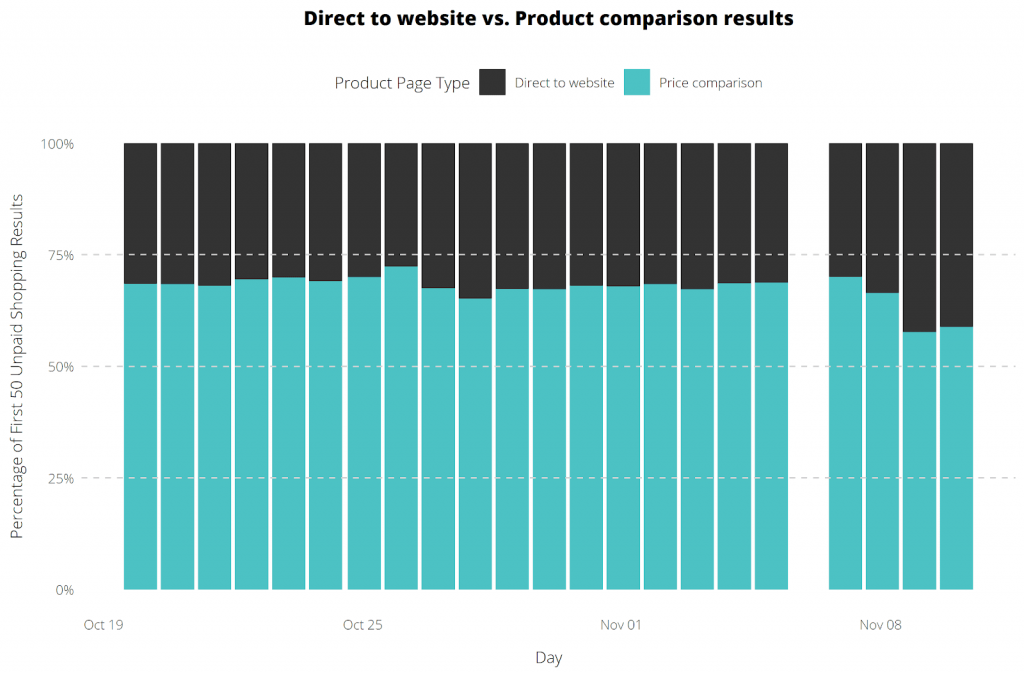

- Around 70% of unpaid shopping results lead to a product comparison page with the remainder clicking straight through to the external website unobstructed by competitor websites selling the same product.

- A competitive Google Shopping strategy must incorporate both paid and organic functions.

Recommendations from our Search Strategists

- Make sure you are tracking the performance of both paid and unpaid listings – by default this isn’t split out in Google Analytics so while you can see some information in Merchant Center you won’t be able to see how much unpaid listings are contributing to your overall performance.

- Pay particular attention to your product markup – reviews and product ratings are showing as a significant factor in the ranking of unpaid listings so the more information you can provide about your product through structured data and on-page content, the better your chances are of appearing.

- Keep track of the products that are appearing and the listing features they trigger – do they show a standard unpaid listing or do they include a link to go through to a product comparison view? Understanding what kind of competition you’re competing with at a product level can help inform other tactics, e.g. if your products are triggering links to comparison pages, you should look at informational content users are searching for around the products, buying guides, or even style guides and inspiration-style content.

How frequently do combination listings appear?

This one’s simple: 100% of the time. And virtually every time, the top row will be filled with ads. The number of ads in the top row depends on the size of your screen but will typically be somewhere between three and six.

How frequently do sites appear in both paid and unpaid listings (in the same search)?

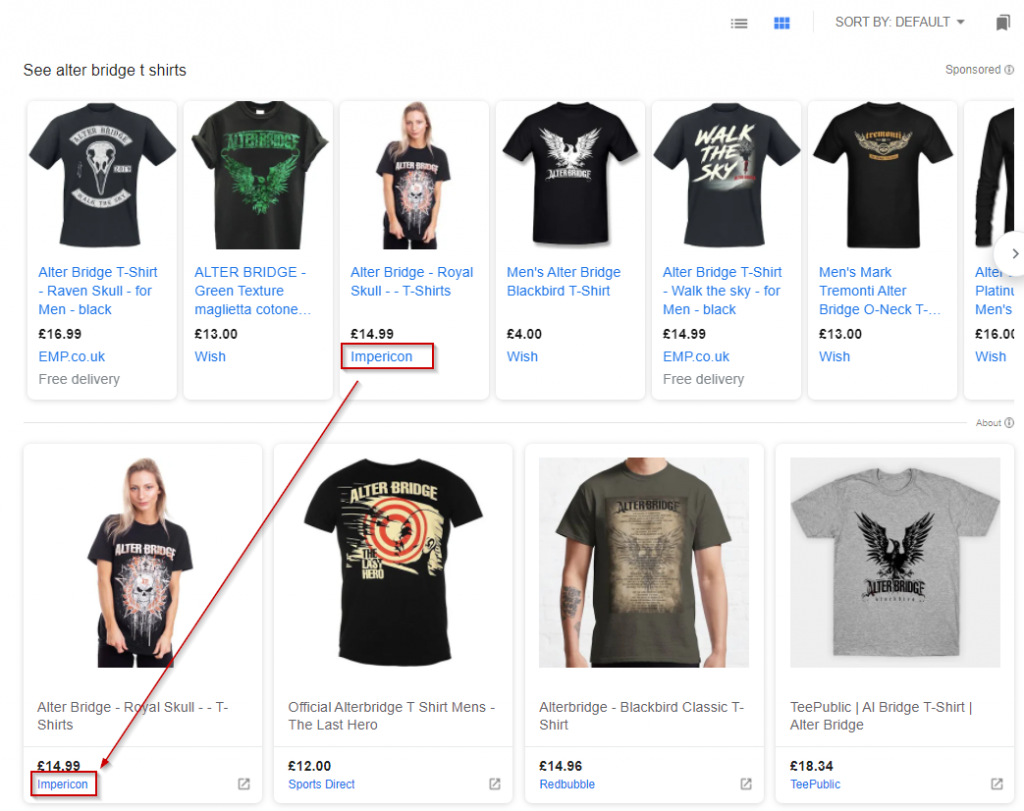

Of all the companies we found appearing across the Shopping results only 7.3% ranked for both visible paid listings and unpaid listings in the same search. It looks like dual listings are a semi-rare event at the moment.

The most notable examples of companies in this minority playing both sides include bigger-name brands: Tempur, Adidas, Trespass, Secret Sales, And So To Bed, MandM Direct, Wayfair, JD Sports and Armani to name a few – all whom appear across both result types more than a third of the time. In most cases this is facilitated by brand-name searches, such as “tempur pillows” or “adidas trainers”.

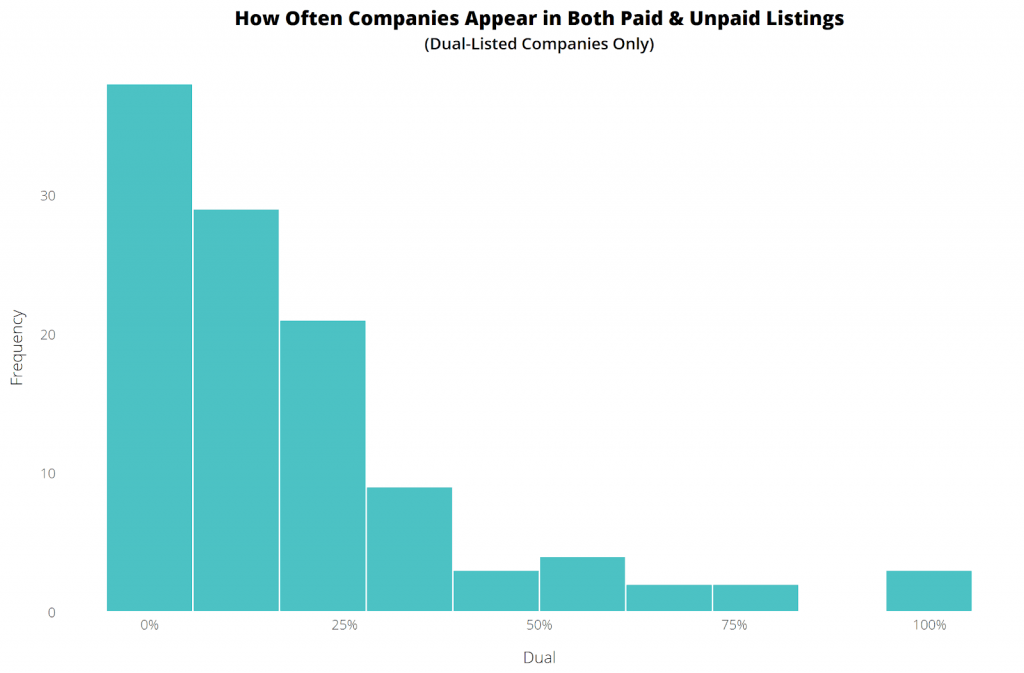

However in the majority of cases, appearing in both paid and unpaid listings is not consistent. The histogram below visualises how often companies that have appeared in both result types continue to do so – most of whom rank for both less than 10% of the time.

The few companies that seem to achieve this dual listing consistently pop up much less frequently overall across our keyword set. In other words, their keyword strategy is a lot more targeted and specific. This includes shoe retailer “Rocket Dog” and sportswear provider “Dare 2b” who both appear in less than 1% of all searches we performed. But when they did they ranked for ads and organic listings every 👏 damn 👏 time 👏.

The majority of distinct companies we discovered across our data set reside in the unpaid shopping results. This speaks to the opportunity available in these listings to reach a larger community of retailers.

We have been going at this from an “overall” point-of-view. That is to say that companies tend not to rank for an ad and an unpaid listing in the same search if we consider every single company we’ve come across in our data. This doesn’t stand up when we only consider companies that ranked for an ad because these companies will quite frequently appear in unpaid listings as well. 30.8% of the companies we identified across ads also appear in the unpaids, brandishing themselves as even more fearsome competitors. Some brands like Armani, Adidas, Converse, DFS and Timberland always appear across paid and unpaid listings. Some rarely do, for example Deichmann, Levi’s and Marc Jacobs.

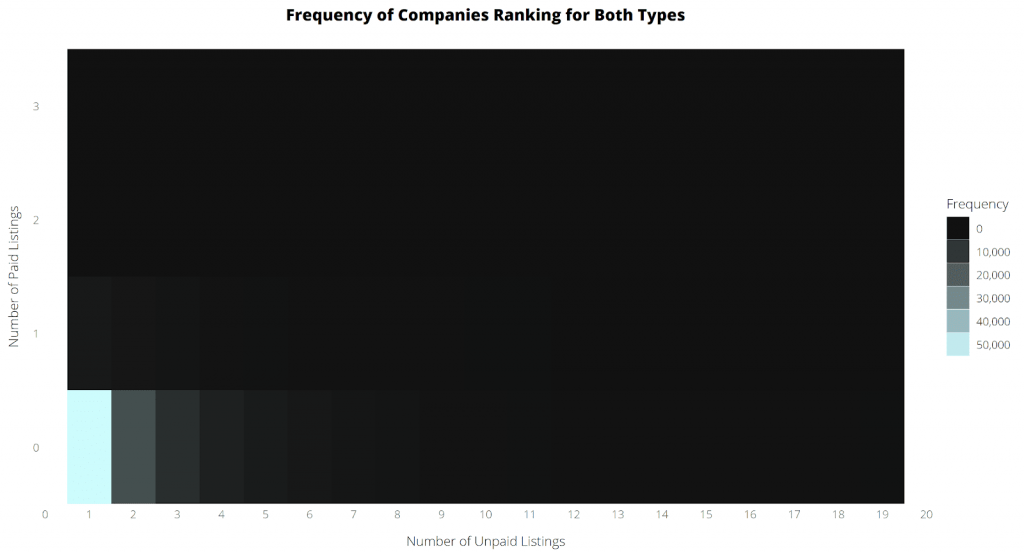

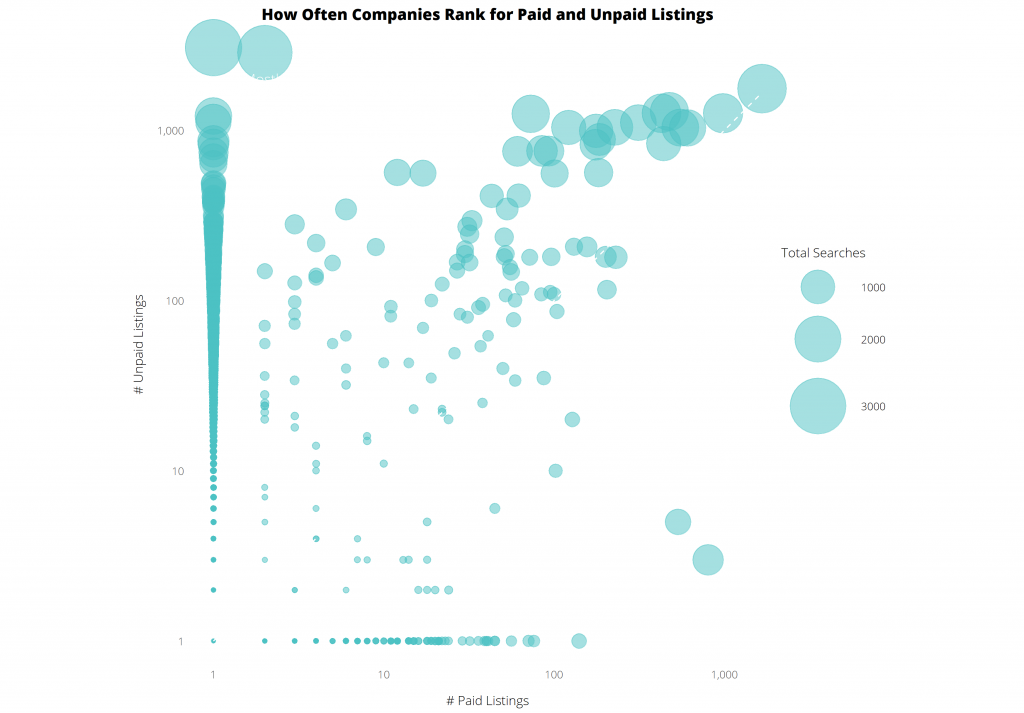

In summary, companies do not frequently rank for both visible* paid and unpaid listings. The chart below shows how most companies will occupy a single organic listing but rarely any visible paid listings in addition. If you maximise the contrast on your monitor and squint real hard you should be able to see some colour where companies rank for both organic and paid listings in a search.

How frequently do sites appear in both types of listing (across multiple searches)?

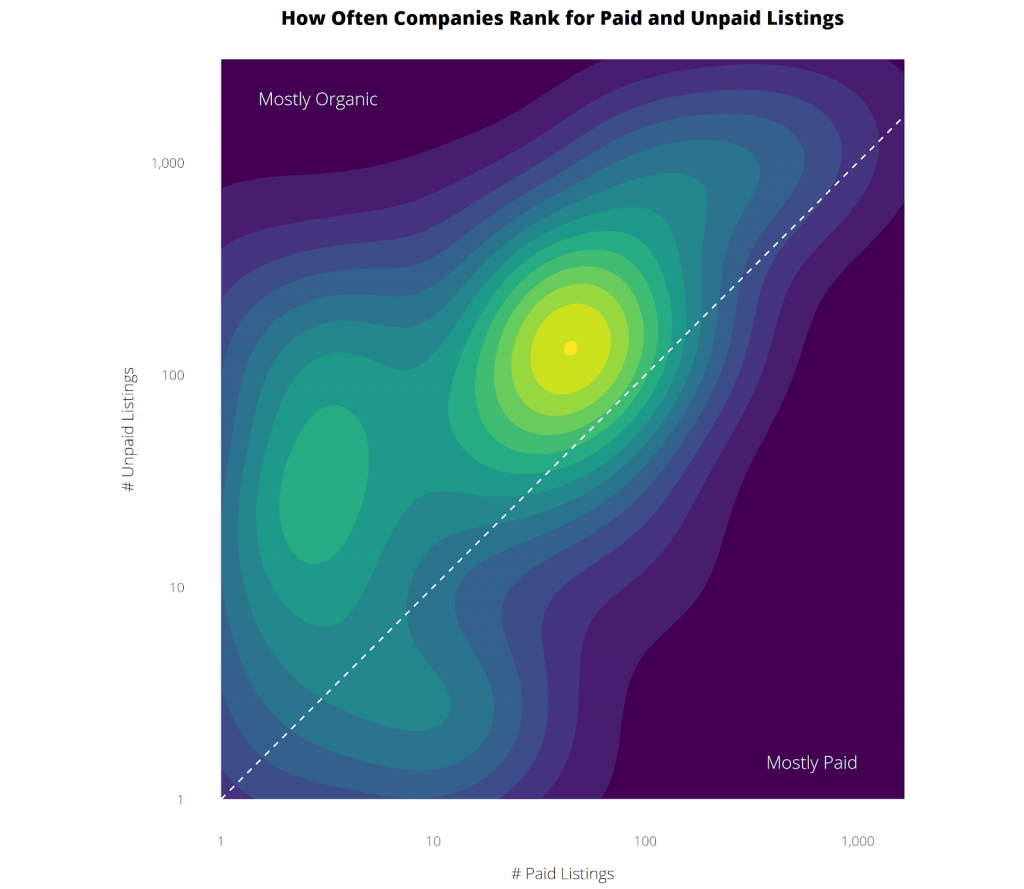

Companies rank more often for organic listings than paid listings but the majority of companies do rank for both across a variety of keywords.

Therefore, shopping strategies should incorporate both organic and paid strategies. The data definitely leans to more organic – meaning well-tagged ecommerce sites will see the benefits from Google’s shopping listings.

To highlight how many companies appear exclusively across organic listings (no visible paid presence), I’ve provided the same graph as above but as a scatter plot instead.

Zalando, Get the Label and Very are examples of companies that appear exclusively across unpaid shopping listings. Amazon and BrandAlley on the other hand appear almost exclusively within the visible ads with virtually no organic presence. Others like MandM Direct, House of Fraser, Schuh and more are much more balanced.

How frequently do the same products appear in both the paid and unpaid listings?

Technically, we have the data to answer this question but matching products found in unpaid listings to products in the paid listings is too great a challenge for this blog post. Maybe next time.

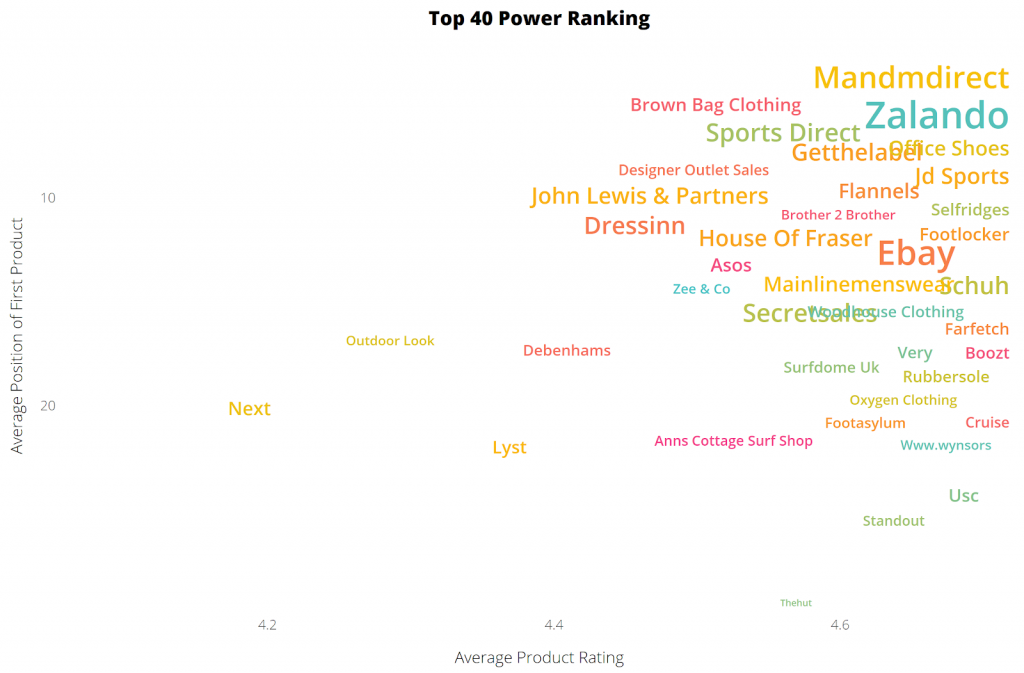

Which websites dominate the unpaid shopping results?

These websites are killing it in the organic shopping results. They rank the most often across all shopping results and when they do rank it is for strong positions and highly-rated products.

This led us to an interesting finding that positive product ratings are moderately correlated with ranking position. The strength of correlation between these two factors is 0.40 (translation: moderate positive relationship).

How are unpaid Shopping listings changing over time?

I’m choosing not to dwell here as it is still very early days yet but here are the patterns we’re seeing.

Shoot back in a few months, I’m sure we’ll (I’ll) have something by then.

Furthermore, organic listings consist of two types of landing page:

1. A click through to an external website

2. A click through to Google’s product price comparison page

Just over a quarter of listings lead straight to the listed retailer’s external website, meaning you’re likely facing more competition than just ranking on Shopping results. More choices for the consumer means less clicks for you. So sad. Of course, you are afforded a boon for owning the outlink in these comparison widgets.

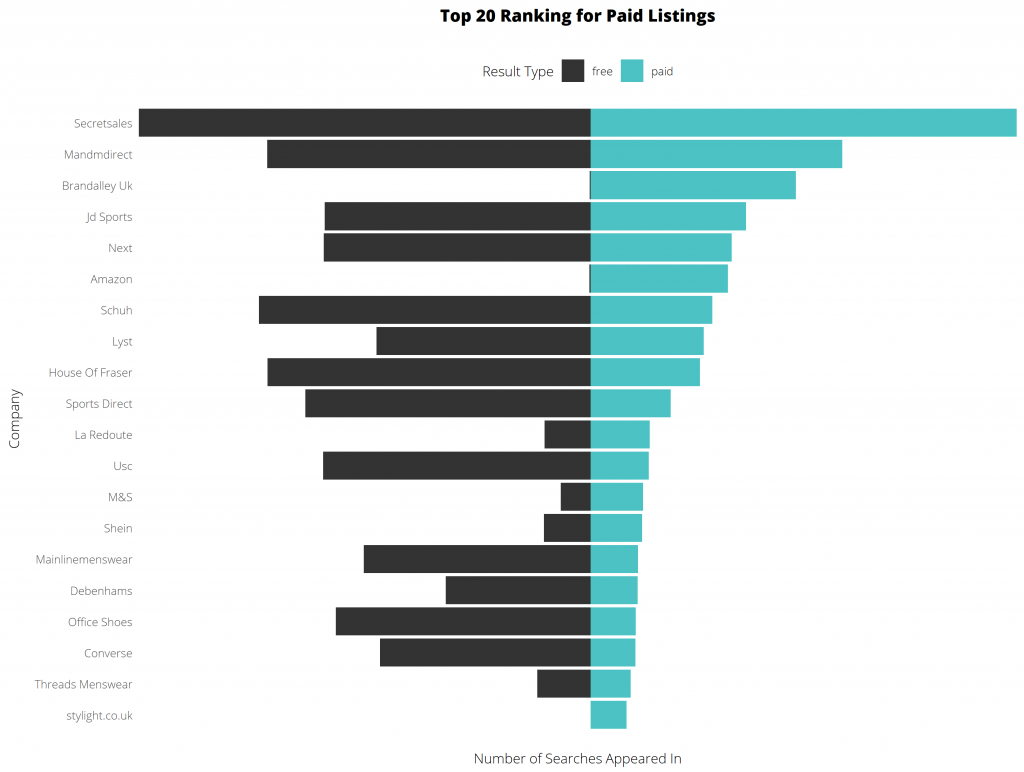

Are we seeing different sites in the paid listings versus the unpaid?

The short answer is yes.

The long answer is yeeeeesssssssss.

I don’t imagine that made you want to keep reading but if you’re undeterred then try this on for size. Of the top twenty sites ranking for paid ads, two have no organic presence whatsoever: Amazon and BrandAlley. Check it:

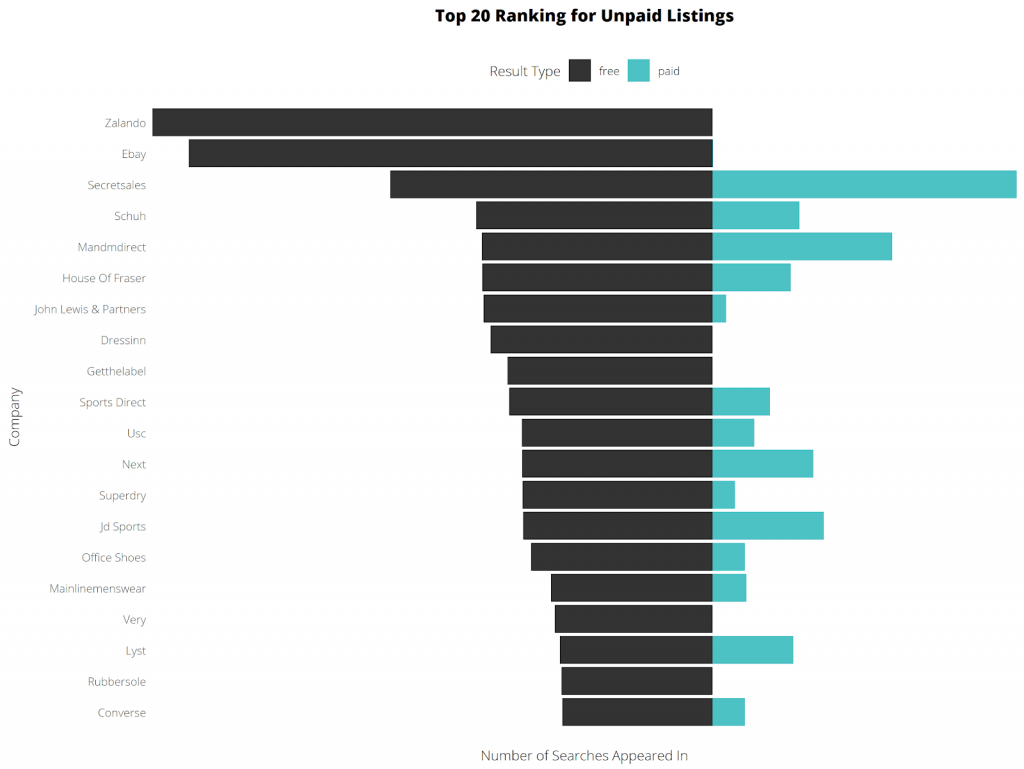

Conversely, if we now look at the top twenty companies competing for organic Shopping listings, more than a quarter abstain from paid activity. And more importantly, companies ranking at the top of the list are very different from the paid rankings. Both are very different environments dominated by their own lords and ladies. (Note: take Ebay’s reading with a pinch of salt as it may not include all Ebay listings…for reasons).

Thank you I’ve been great.